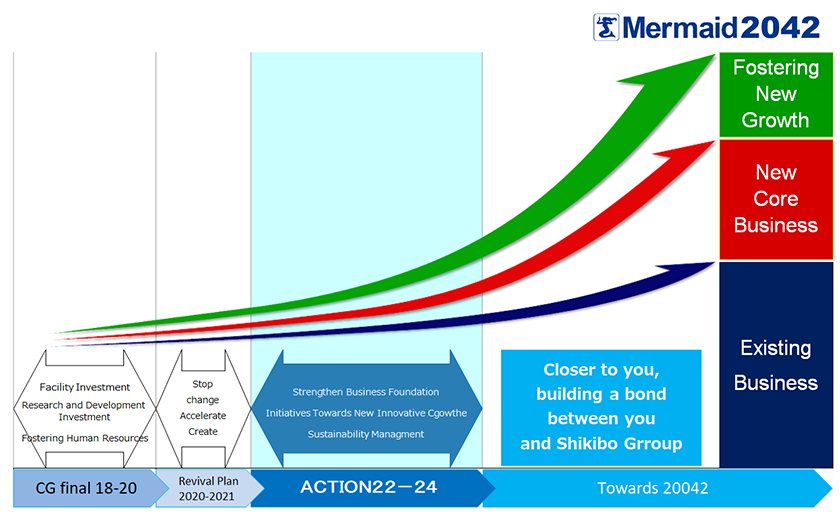

Medium-term business plan

March 31, 2022

Our group's board of directors decided on a medium-term business plan called ACTION 22-24 that covers the three-year period from FY2022 to FY2024 at the March 31, 2022 meeting of the board of directors.

In this medium-term business plan, we aim for recovery from the COVID-19 pandemic, further accelerating our level of growth towards the realization of our long-term vision, creating new things and taking on new initiatives. We put forward 1 the strengthening of our business foundation, 2 initiatives for the next innovative growth, and 3 initiatives towards sustainability management as the three basic policies for that sake.

We will actively invest to improve corporate value in order to develop the chemical product business, which is positioned as a new core business, to the next stage. For example, we will invest in facilities to expand sales of our mainstay thickeners and stabilizers for food, cultivate new growth buds following the new core businesses, and conduct research and development. In addition to this, we will strengthen our business foundation by introducing a Return On Invested Capital (ROIC) venture management index and putting our focus on revising our business portfolio and on improving our profitability for our existing business with importance given to capital efficiency. Additionally, we will make our human capital more substantial by acquiring and fostering diverse human resources. Additionally, we will make progress with global expansion and expansion into growth regions.

Basic Policies

1. Strengthen Business Foundation

- Further expansion of the scale of chemical product and composite material businesses positioned as new core businesses

- Facility investment towards development of new markets (chemical product business (primarily in the field of food) and linen supply business)

- Increasing customers through developing new usages and new markets

- Development of overseas markets through strengthening global network domestic and foreign cooperation

- Improving our profitability for our existing business with importance given to capital efficiency and revising our business portfolio

- Further strengthening of our financial base

- Enriching human capital through systematic education of employees

- Investment in digitalization to improve productivity and business efficiency

2. Initiatives Towards the Next Innovative Growth

- Promotion of fostering of new business seeds following the new core business and of research and development

- Acquisition and fostering of diverse human resources to support global development and development into growth regions

3. Sustainability Management Initiatives

- Further strengthening of development and sale of eco-friendly products and products that will solve societal issues

- Investment in facilities that contribute to the realization of a carbon-neutral society

- Creation of a workplace and institutions that provide a sense of fulfillment and meaningful work aimed at increasing employee engagement

Numerical Targets

1.Sales and operating profit by segment

(hundred million)

| FY2021 | FY2022PLAN | FY2023PLAN | FY2024PLAN | |

|---|---|---|---|---|

| Textile | 186 / △5 | 192 / 0 | 218 / 2 | 230 / 5 |

| Industrial Materials | 120 / 7 | 126 / 6 | 128 / 6 | 132 / 8 |

| Real Estate Business & Service Industry | 56 / 18 | 58 / 18 | 60 / 18 | 64 / 19 |

| adjustment | △6 / △7 | △6 / △7 | △6 / △7 | △6 / △7 |

| total (Consolidated) | 357 / 14 | 370 / 17 | 400 / 19 | 420 / 25 |

2.Consolidated profit and loss

(hundred million)

| FY2021 | FY2022PLAN | FY2023PLAN | FY2024PLAN | |

|---|---|---|---|---|

| Sales | 357 | 370 | 400 | 420 |

| Operating Profit | 14 | 17 | 19 | 25 |

| Ordinary Profit | 10 | 14 | 15 | 22 |

| Net Profit Belonging to Stockholders of Parent Company | 0 | 15 | 10 | 15 |

Individual strategy by segment

Textile Segment

Business strategy

Aim to strengthen vertical and horizontal affiliation inside and outside of the segments, improve production, sales, and development technology for better overall performance, and improve results

Fundamental strategy

- Promote the development of new markets through the development of new products and new uses for existing products responding to changes in existing markets

- Conduct sales activities and utilization of production foundation beyond field barriers and across the group

- Expand overseas sales by strengthening cooperation with a global network

- Strengthen development and sale of eco-friendly products

Industrial Materials Segment [Industrials Materials Division]

Business strategy

Aim to proceed with innovation towards a sales structure and a production structure that respond to the market environment that has changed significantly, and maintain and improve earning power

Fundamental strategy

- Maintain top share in the domestic market

- Expand overseas sales and improve earning power

- Develop production structure and facilities fit for the market

- Create new markets that can utilize our company's endemic technologies, products, and facilities

- Create a strategy for the development and sale of eco-friendly products

Industrial Materials Segment [Functional Materials Division]

Business strategy

Promote an execution plan with growth that ascertains the long-term vision Mermaid 2042

Fundamental strategy

- Chemical Product Business

Rebuild production structure and expand sales routes to contribute to the lives of people with plant-based food additives that are safe and reliable - Composite Material Business

Strengthen organizational foundation, strengthen research and development structure, and promote market development to contribute to the energy industry with "light and strong" composite materials

Real Estate Business & Service Industry Segment

Business strategy

Maintain and expand a stable earning foundation with an eye to the post-COVID world

Fundamental strategy

- Real Estate Rental Business

Promote the maintenance of the value of existing facilities and assets and effective utilization of idle assets - Linen Supply Business

Renew and reinforce facilities to expand the business in view of the earnest recovery after the COVID-19 pandemic and the Osaka Expo 2025

Facility Investment Plan

(hundred million)

| Fiber | Industrial Materials | Real Estate, Service | Overall | Total | |

|---|---|---|---|---|---|

| ACTION22−24 | 10 | 31 | 13 | 5 | 59 |

Cash Flow Plan

(hundred million)

| FY2022PLAN | FY2023PLAN | FY2024PLAN | ACTION22-24 TOTAL | |

|---|---|---|---|---|

| Business Cash Flow | 23 | 23 | 27 | 73 |

| [Depreciation Cost] | (17) | (18) | (19) | (54) |

| Investment Cash Flow | △13 | △32 | △10 | △5 |

| Free Cash Flow | 10 | △9 | 17 | 18 |

Management Indices

| FY2022PLAN | FY2023PLAN | FY2024PLAN | |

|---|---|---|---|

| Interest Bearing Liabilities [hundred million] Debt Equity ratio |

237 0.73 |

253 0.76 |

242 0.71 |

| Equity Ratio | 39.8% | 39.5% | 40.6% |

| ROA | 1.7% | 1.8% | 2.6% |

| ROE | 4.7% | 3.0% | 4.5% |

| ROIC | 2.1% | 2.2% | 2.7% |

Capitalization Strategy

We aim at sustainable growth and at improving corporate value over the medium to long term by investing towards the further strengthening of our financial base, the achievement of our ACTION 22-24 plan, and sustainable growth.

Return to Stockholders Measures

[Basic Policies]

Our company places the appropriate profit return to stockholders as one of the most important issues in our business. Stably continuing with dividends is our basic policy regarding profit sharing, and decisions are being made with comprehensive consideration given to consolidated results and business developments moving forward. Through the promotion of ACTION 22-24, we are planning to make initiatives to strengthen our business foundation and for our next innovative growth more substantial, aiming to increase dividends further.

Towards sustainability management

Towards the realization of a sustainable society, we gave thought to the overall effect on the young workers who will be shouldering the next generation, our stakeholders, and each business area, and identified six materialities we should prioritize engaging in. We introduce our sustainability management initiatives with regard to each materiality and its important business activities.

Details of the medium-term ACTION 22-24 plan can be found here.[Japanese only]